Ways to Calculate the Inventory Turnover Ratio

Jan 08, 2024 By Susan Kelly

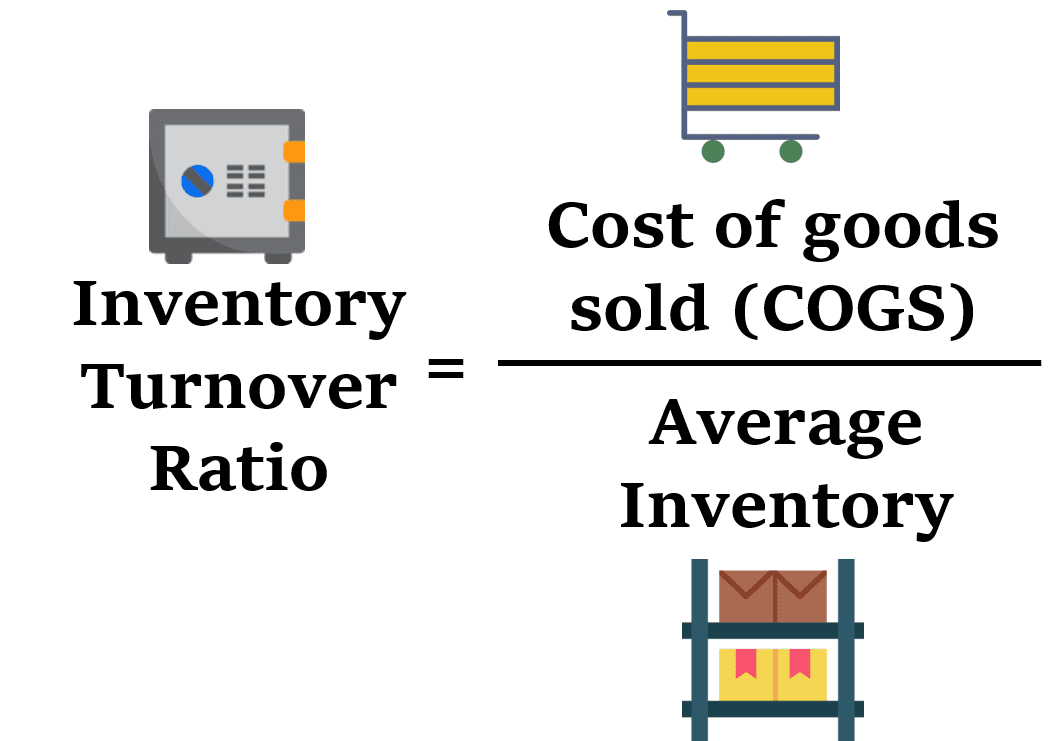

In other words, inventory turnover refers to the number of times that Inventory has been sold over a certain period. You may calculate the inventory turnover ratio by dividing the cost of products sold by the average Inventory for a certain period. This will give you the ratio. Because most companies encounter shifting sales during the year, using their current Inventory in the calculation might lead to inaccurate findings.

Because of this, the average Inventory is utilized instead of the current Inventory in the calculation. For instance, the number of items in stock at retail establishments like Macy's Inc. (M) may increase in the months leading up to the holidays and decrease in the months following the holidays. When calculating inventory turnover to account for seasonal shifts in sales, it is common to practice utilizing the average Inventory as the starting point. The total is then divided in half to arrive at the average Inventory.

The Formula for the Inventory Turnover Ratio

The formula for calculating inventory turnover is as follows: Cost of Goods Sold divided by ((Beginning Inventory + Ending Inventory) divided by 2)

Another method for calculating inventory turnover is dividing total sales by the number of goods in stock. However, since sales are normally recorded at market value and Inventory is recorded at cost, this comparison has the potential to create findings that are exaggerated for no good reason. Most businesses use the cost of goods sold (COGS) as the numerator rather than total sales. This is because COGS accurately represents the cost of manufacturing items for sale while excluding retail markup.

Interpreting Inventory Turnover

The inventory turnover ratio is a useful metric for businesses when making choices on production, sales performance, and marketing. The ratio provides management with valuable information about the success of both sales and inventory purchases. If, for instance, there is a large amount of Inventory, this might indicate that either the company's sales are not meeting expectations or they acquired an excessive amount of Inventory. As a reaction, either the company's sales need to go up, or the extra Inventory might end up costing it money in the form of storage costs. The sales and the number of inventory acquisitions must sync with one another. In the end, it will be reflected in the inventory turnover ratio if the two are not in sync with one another.

Why Inventory Turnover Matters

Therefore, the current inventory ratio of a company should always be compared to the company's historical performance and the performance of other companies operating in the same industry as the company in question. The optimal inventory turnover ratio depends on the business and the industry. A low ratio might indicate poor sales or an excessive supply of goods, depending on the context. A lack of market success may result from an inefficient advertising campaign, an inferior product, excessive pricing, or an outdated product offering. An additional expense that may result from having an excessive amount of Inventory is the cost of producing that Inventory, which continues to accrue even. At the same time, it is not being sold to customers.

Even if a high inventory turnover ratio is better than a low one, this metric does not always indicate that a company strategy is always effective. A high ratio can indicate that sales are doing well. On the other hand, a high ratio might also be the result of insufficient inventory levels; in this case, the firm risks losing consumers since orders won't be able to be fulfilled on time to match sales. The rate at which a corporation uses up its Inventory is a good indicator of its liquidity. For instance, if a corporation cannot swiftly turn over its Inventory, the company may have difficulties with its cash flow. On the other hand, a firm with a greater turnover rate and operating more effectively would earn cash extremely rapidly.

Most of the time, financial institutions and other creditors will accept Inventory as collateral for loans. Consequently, it is essential for a firm to verify that they have the sales to match their inventory purchases and that the process is handled appropriately. Different industries have different average inventory turnover rates. For example, automobile manufacturers could have a smaller ratio than apparel manufacturers. The financial accounts of a company provide access to all the data required to compute its inventory turnover rate. On the income statement, you will find the COGS, and on the balance sheet, you will find both the beginning and ending Inventory.

Earnings Face-Off: Uber vs. Lyft for Drivers

Roth and Traditional IRA Contribution Limits

Client Explanations on Soaring Interest Rates and Real Estate

All About Innocent Spouse Relief

Methods for Entering the World of Venture Capital

Why We Often Choose Now Over Later: A Look at Temporal Discounting

How to Sell a Car: Everything You Should Know

What Is A Mortgage? Classes, Operation, and Typical Applications

Ways to Calculate the Inventory Turnover Ratio