What Is A Mortgage? Classes, Operation, and Typical Applications

Nov 07, 2023 By Susan Kelly

Home, land, and another real estate can all be purchased using a mortgage, which is a specific sort of financing. An installment loan is one in which the borrower and lender agree for the borrower to make periodic payments to the lender of both principal and interest.

In this way, the property itself secures the loan. A mortgage application through the borrower's preferred lender is contingent upon the borrower's meeting specific criteria, such as having a good credit history and saving enough money for a down payment.

To get to the final closing step, mortgage applicants must pass through a thorough underwriting procedure. Many different kinds of mortgages are available to suit a wide range of situations and budgets.

The Basics of Mortgages

Mortgages allow buyers to finance real estate acquisitions. Over a certain period, the borrower will pay back the loan principal plus interest. Full amortization is standard in conventional mortgages.

This implies that the loan's regular payment amount will remain the same, but the loan's principal and interest will be paid back in varying amounts during the term of the loan. The standard mortgage term length is 15 years. However, 30 years is also common.

Methods of Obtaining a Mortgage

Possible borrowers should start by submitting loan applications to mortgage institutions. Lenders typically need borrowers to prove their financial stability before approving a loan. Some examples include confirmation of current job, tax records, and statements from financial accounts.

Additionally, the lender may do a credit check. Loan amounts and interest rates are subject to the lender's approval of the borrower's application. Pre-approval allows homebuyers to apply for a mortgage after finding the perfect house or while they are still looking.

Mortgage Borrowing Options

There are many different kinds of mortgages. 30-year and 15-year fixed-rate mortgages dominate the market. Mortgages come with maturities ranging from as little as five to as much as forty years. Paying out a loan over an extended period can cut monthly payments but will result in the borrower paying more interest overall.

Federal Housing Administration loans, U.S. Department of Agriculture loans, and U.S. Department of Veterans Affairs loans are just a few of the many types of home loans available across a range of terms for people who may not have the income, credit score, or down payment necessary to qualify for conventional mortgages.

Fixed-Rate Mortgages

A fixed-rate mortgage is the most common form of a loan. A fixed-rate mortgage is one in which the interest rate and the monthly payment remain constant during the life of the loan. One name for a mortgage with a fixed interest rate is a "conventional" mortgage.

Adjustable-Rate Mortgage (ARM)

An ARM is a mortgage in which the interest rate is fixed for a set time but then fluctuates at regular intervals based on market conditions. Mortgages may be cheaper initially because of an interest rate lower than the market rate; if that rate eventually rises, the mortgage may become unaffordable.

Interest-Only Loans

Due to the complexity of their repayment schedules, interest-only mortgages and payment-option adjustable-rate mortgages are two other, less prevalent forms of mortgages that savvy borrowers best employ. A significant balloon payment is sometimes required at the end of these loans. During the housing boom of the early 2000s, many borrowers with this sort of mortgage found themselves in severe financial distress.

Reverse Mortgages

In contrast to conventional mortgages, reverse mortgages are what they sound like: a way to get money from the lender. Homeowners 62 and up can take advantage of these loans if they wish to turn some of their home's equity into cash.

These homeowners can take out a loan secured by their house and get the funds as a one-time lump amount, an established monthly payment plan, or an ongoing line of credit. In the event of the borrower's death, permanent relocation, or home sale, the whole loan sum is payable.

Rates On Average Mortgages

The total cost of a mortgage will vary based on several factors, including the type of loan taken out, how long it will be, the number of discount points paid, and the current interest rate. It's best to compare shops for an interest rate because it might change weekly and from lender to loan.

In 2020, mortgage rates reached historic lows, with the 30-year fixed-rate mortgage averaging just 2.66% during the week ending December 24, 2020. 5 The interest rate was relatively low during 2021 but has progressively increased since December 3.

Nelnet Student Loan Servicing

An Ultimate Guide: What Is the HUD-1 Settlement Statement?

Methods for Entering the World of Venture Capital

Securing Your Finances: 5 Effective Strategies Against Medicare Fraud

How Losing a Spouse Affects Your Tax Situation: A Comprehensive Overview?

All About Innocent Spouse Relief

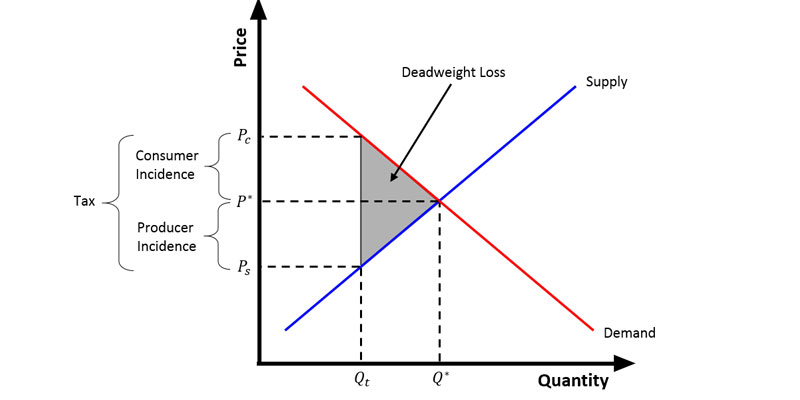

Tax Wedge

What is Bankruptcy, and How Does It Work? A Comprehensive Guide

Employees Want Help Understanding Benefits Offered by Employers