Do You Know: What Is a Qualifying Life Event?

Oct 25, 2023 By Susan Kelly

Introduction

What is a qualifying life event? For employees to be eligible to make changes to their health insurance elections outside the annual open enrollment period, a "qualifying life event" must have occurred. The birth of a kid, a move, or marriage all qualify as major life changes. Any of the following events can qualify as a QLE during the year. The standard window for enrolling in or switching health plans following a qualifying occurrence is 60 days. If you are relocating to a new location covered by your health insurance provider, you can submit your application up to 60 days in advance. You have sixty days before and after losing employer-provided health insurance to sign up for a new health plan.

List of the Qualifying Life Events

They are having or becoming reliant on another person due to giving birth or adopting a child. They are about to tie the knot. The applicant or a dependent no longer has access to minimal essential coverage because of a change in job status or termination. The termination of the company's commitment toward covering an employee or their dependents. The applicant's coverage source has passed away. The loss of dependent coverage due to the subscriber's entitlement to Medicare benefits under Title XVIII of the Social Security Act.

Loss of dependent status, as defined by the terms of a group plan, such as the child turning 26 years old. Loss of essential health benefits other than loss due to nonpayment of premiums or rescindable circumstances. A person who, by marriage or domestic partnership, becomes or acquires a dependent. Coverage of the dependent is compelled by a valid state or federal court order. If the applicant's former spouse or partner provided dependent coverage before their legal separation or divorce, the applicant might be eligible for that continuation.

Loss of Health Insurance

- When a person reaches the age of 26, they are no longer eligible for their parent's health insurance.

- Compromising your health care needs after losing your job-based, COBRA, or student plan.

- Getting kicked off of government health programs like Medicare, Medicaid, or the CHIP.

- Inability to keep health insurance for any cause other than nonpayment of premiums

Turning 26

At age 26, you are no longer eligible to remain dependent on your parent's health insurance plan. If you turn 26 during the year and your parents have a State-Based Exchange plan, you can remain on your parent's plan until coverage ends on December 31. However, the Open Enrollment period for next year's State-Based Exchange plans ends on December 15. Your parents need to submit an updated application indicating that you will not be included in their coverage next year.

When you turn 26, your coverage via your parents' employer plan will stop. The loss of previous coverage will qualify you for a SEP, so getting a plan through the State Based Exchange doesn't matter if it's outside the Open Enrollment Period. You have 60 days to enroll in coverage and another 60 days after coverage ends. The State-Based Exchange may need proof that you no longer have coverage.

Turning 65

The occurrence of one's 65th birthday is a special Qualifying Life Event since it is the first opportunity to enroll in Medicare. This time frame is known as "Initial Enrollment." It begins three months before the month in which you turn 65 and continues for another three months following that.

Changes in Household

- Entering into a marriage, separating, or ending a marriage.

- Bringing a child into one's family, whether by birth, adoption, or foster care.

- The passing of an insured family member or spouse.

Chances in Residence

- We are shifting residence to a new county or postal code.

- To or from school transportation for children.

- Transportation to and from job locations for seasonal workers.

- We are changing residences from one transitional or emergency housing facility to another.

- Transportation from a foreign country or U.S. territory to the United States.

Other Qualifying Changes

- The degree to which your income has changed and is influencing your Medicaid eligibility.

- After signing up for an ACA plan, you may qualify for premium tax credits.

- Acceptance into a nationally recognized tribe.

- To qualify for Health Insurance through the Marketplace after becoming a U.S. citizen.

- A resource for new and departing VISTA members of AmeriCorps.

- Get out of jail free card.

What Kind of Health Plan Can I Apply for with a Qualifying Life Event?

QLE holders have access to all health plans on GetCovered.NJ.gov and amerihealthnj.com. Applying straight through AmeriHealth New Jersey may provide access to cost-cutting measures, but you will not be eligible for tax credits.

Conclusion

In California, new enrollees can only be added to individual/family and group health plans during the yearly open enrollment period. If people could sign up whenever they wanted, some may wait until they were sick before buying insurance, which would make the system ineffective. It's not always possible to enroll during the once-a-year open enrollment period. These occurrences are "qualifying life events," allowing you to adjust your insurance plan or purchase new coverage.

Understanding Sales Tax on Used Cars: What Buyers Need to Understand

Simplifying Health Insurance Premiums: What You Need to Know

How to Sell a Car: Everything You Should Know

What is Bankruptcy, and How Does It Work? A Comprehensive Guide

Earnings Face-Off: Uber vs. Lyft for Drivers

Financial Advisor Scams

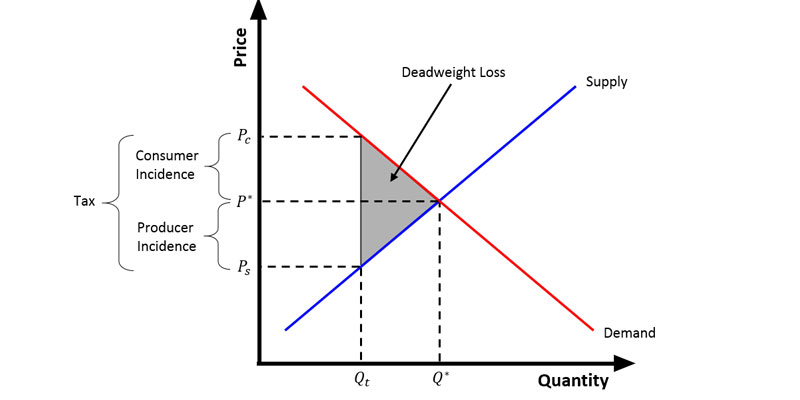

Tax Wedge

What Is a Catastrophe Insurance?

Securing Your Finances: 5 Effective Strategies Against Medicare Fraud